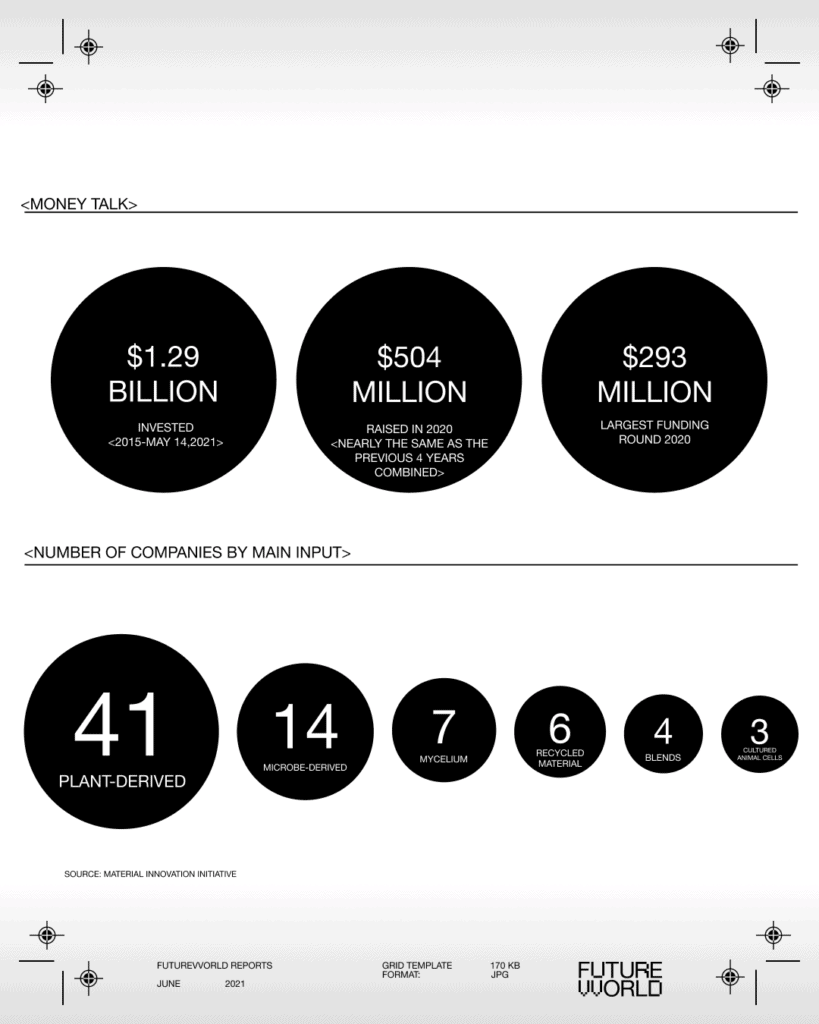

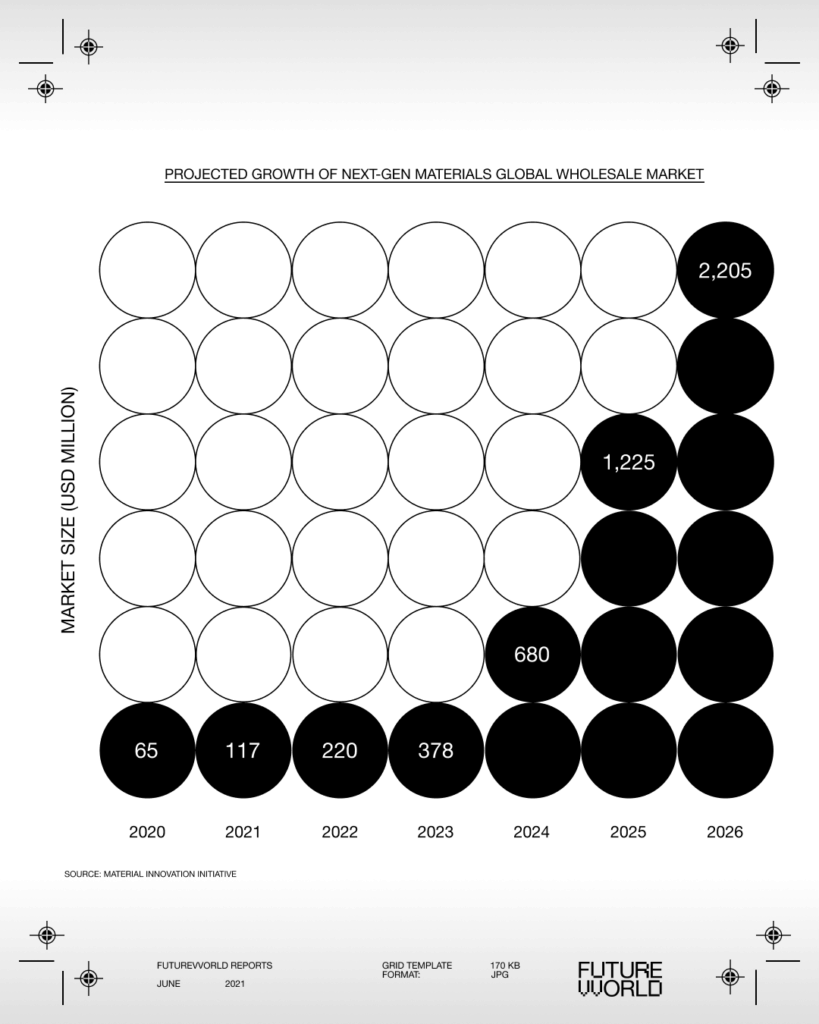

Last week, The Material Innovation Initiative published a first-of-its-kind paper named State of the Industry Report: Next-Gen Materials, revealing some impressive figures on the trends within sustainable materials: $1.29 billion was invested in the category between 2015 and 2021 with $504 million invested in 2020 alone, almost as much as in the four previous years combined.

The report also revealed that there are 74 Next Gen companies in operation, with 49 in the category of vegan leather; that there are 95 unique investors in the industry; and that, interestingly, 38 out of 40 leading fashion brands are “actively seeking” Next Gen materials.

The data is certainly extremely encouraging, and we were keen to delve further, so we took a deep dive with sustainable materials expert Allen Zelden, an industry figure closely connected with vegan business with a focus on sustainable materials in his latest venture FutureVVorld.

Can you summarise the present situation in sustainable materials and what this latest report represents?

Encouraged by the thriving plant-based food movement, consumers all around the world are now looking to the apparel and textile industries for greater transparency and accountability, hence the growth for those working within the nexus of materials, ethics and sustainability.

“these findings from the MII are a moment of significance and endorsement in the great global interest – and surging demand – for improved material choices”

With greater awareness of the textile industry’s harmful environmental impact and exploitative work practices, these findings from the MII are a moment of significance and endorsement in the great global interest – and surging demand – for improved material choices.

How aware, in your opinion, are fashion brands about the importance of sustainable materials, and what needs to be done by them?

In our increasingly competitive market where Generation Z is fast becoming the largest and most influential generation of consumers, the winners will ultimately be those fashion brands that continue to see sustainability not as a downside risk but as an upside opportunity.

In a McKinsey & Company report from July 2020, “67% [of surveyed consumers] consider the use of sustainable materials to be an important purchasing factor, and 63% consider a brand’s promotion of sustainability in the same way.”

So as fashion brands shift their focus to attract the conscious consumer, they will have to invest in greater transparency around their practices and material choices if they wish to forge better and longer lasting relationships with consumers.

What are the most exciting trends you have seen emerging in the field and what do you think will be the most successful in the coming years?

Given the growing environmental and animal welfare concerns surrounding animal-based materials, the footwear category appears to be making the greatest headway in amplifying a more environmentally responsible message.

With Nike, adidas and Reebok all launching many of their own vegan-friendly, recycled materials and alternative-leather designs this year, and with millions of dollars continuing to pour into non-animal-leather start-ups, eco-footwear is becoming increasingly popular amongst consumers.

“the footwear category is set to experience the most disruption as brands continue to turn away from animal skins”

In recent months alone, we’ve seen grape leather popularly used in PANGAIA’s sneakers, pineapple leaf leather from Ananas Anam embraced by Nike, Natural Fiber Welding’s Mirium material used by Allbirds, as well as Bolt Thread’s Mylo “mushroom” leather material making high-profile announcements with Adidas and Stella McCartney.

Clearly, the alternative leather market is booming. With an estimated market value of $89.6 billion by 2025 (Infinium Global Research), and more than $200 million recently invested in alternative leather start-ups, the footwear category is set to experience the most disruption as brands continue to turn away from animal skins as their primary material.

According to the report, 42 new companies formed since 2014 in this category – which stand out to you or which have you worked with to increase sustainability targets?

As consumers progressively learn of the many devastating environmental impacts of animal agriculture, it’s no wonder leading brands such as Nike, Gucci & Hermès continue to express an active and exponential interest in next-gen materials to help achieve their sustainability targets.

Adidas recent €3 million EUR ($3.65 million USD) investment in sustainable material company Spinnova is a really exciting example of this.

Using Spinnova’s recyclable and biodegradable textile fibers made from wood, leather, textile and food waste, this newly announced partnership will significantly reduce adidas’ CO2 emissions and water use as it aims to make 90% of garments “sustainable” in some aspect by 2025.

The report cites plant-derived, microbe-derived, mycelium, recycled material, blends, and cultured animal cells derived materials as areas of growth in alt gen materials. Can you comment as to which do you see offering the most opportunity for investors and which is the most interesting to you and why?

As consumers turn away from fur due to animal welfare concerns, it only makes sense this sentiment would trickle down to animal skins as well, hence why alternative leather is seeing the greatest interest by both industry and investors.

Currently, mycelium leather is generating the most attention thanks to the efforts of Bolt Threads and MycoWorks, and their many high-profile partnerships with the likes of Stella McCartney and Hermes respectively.

“cell-based leather will almost certainly become an industry standard”

Then you have companies such as Modern Meadow and VitroLabs, that are looking beyond traditional alternative materials by making leather grown directly from the cultivation of animal cells. Once these companies overcome their commercial hurdles to market, cell-based leather will almost certainly become an industry standard by virtue of its direct likeness and environmental benefits.

Another category that’s ripe for material disruption is silk. With PETA estimating that 6,600 silkworms are killed for just one kilogram of silk, polyester has long been the favoured ethical substitute. However, due to its enormous manufacturing reliance on oil, as well as its inability to biodegrade back to the Earth, the petroleum-based material claims an astonishing environmental toll.

Prior to launching their Mylo material, Bolt Threads invented Microsilk, a sustainably produced textile made through a process of fermenting water, yeast and sugar with spider DNA. Since then, the company has raised $123 million and though the material has only been used in exhibits by Stella McCartney, it’s likely we’ll see many commercial collaborations announced soon.

The future certainly holds vast potential for producers and investors in this area. We will continue to report and follow up on the crucial work done in the industry. Many thanks to Allen Zelden for his invaluable insight.