The demand for healthy and environmentally-friendly drinks is growing, especially among the younger generation. This may explain why smaller brands are increasingly selling their products in glass containers. “The future of the industry will depend decisively on whether production, sales, and marketing can meet the demands of young customers,” says Axel Erhard, consumer goods expert and partner at management consultancy A.T. Kearney.

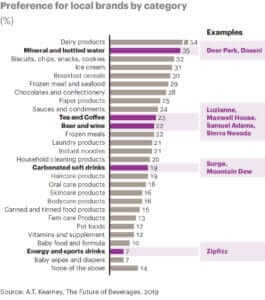

A recent study by A.T. Kearney analyzed the future of the beverage industry. In addition to product, supply chain, and brand areas, the study also examined the beverage consumption behavior of Generation Z, i.e. those customers born between 1998 and 2017. One of the results: in their consumption, young people are increasingly guided by their own values. In addition to personalized products and authenticity, they attach even greater importance to regionalism than their predecessors, especially when it comes to beverages. For example, mineral water ranks second among those product groups for which regional brands are preferred.

“Generation Z is also characterized by strong health awareness. This is being felt in the market for traditional soft drinks and alcoholic beverages – it is shrinking,” Erhard says. In addition, there is regulatory pressure from politics, for example through the taxation of sugar. Consumers are feeling this and are looking for alternatives.

In addition to health considerations and regionality, young consumers also make their beverage choices based on the brand – but are increasingly choosing smaller brands. For example, 52 percent of Generation Z consumers in Germany have little or no confidence in major brands. Only 17 percent say this about small brands. For a generation that is mostly online, more and more producers are focusing on direct sales; AmazonFresh and the rapidly growing startup Flaschenpost are showing the way. They offer a large selection of smaller brands, deliver directly to the customer, and also have more and more private labels in their ranges. “Established beverage manufacturers should analyse the image of small, rapidly growing brands and identify their strengths. When it comes to sales and marketing, they can still learn a lot from them,” Erhard says.