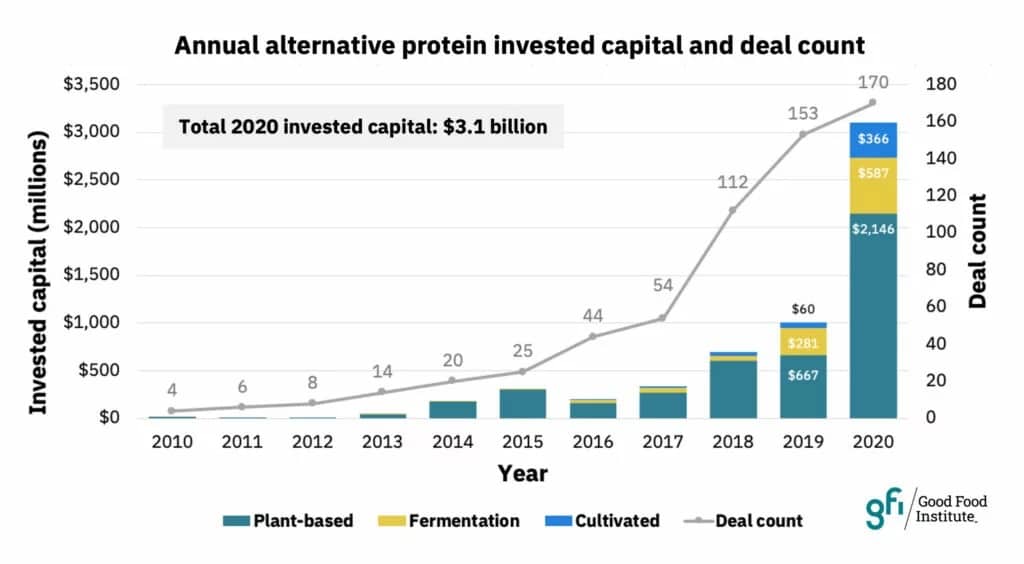

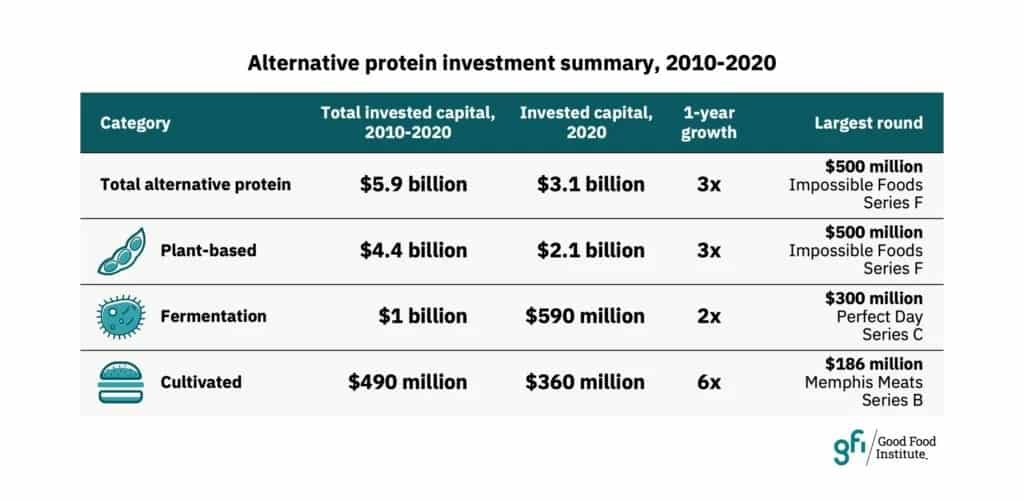

As the social, environmental, and economic changes taking place in the wake of the global pandemic continue to take effect, new data revealed by the GFI today highlights 2020 as a “record period of investment” in companies producing alt protein. Companies producing alternatives to animal products raised almost $6 billion in the past decade (2010–2020), over half of which was raised in 2020 alone.

The report states that global alternative protein companies received $3.1 billion in disclosed investments in 2020, which is more than three times as much as the $1 billion raised in 2019 and four and a half times as much as the $694 million raised in 2018.

The GFI describes that the insight offered by these astonishing numbers reflect that the “prospect of meat produced with zero risk of contributing to zoonotic disease transmission or antibiotic resistance has even greater relevance,” and that investors are increasingly acknowledging that, since climate risk is investment risk, “alternative proteins offer a scalable solution that gets the world closer to a more secure, carbon-neutral food system.”

Plant-based meat, egg, and dairy

Received $2.1 billion in investments in 2020 — the most capital raised in any single year in the industry’s history and more than three times the $667 million raised in 2019. Plant-based meat, egg, and dairy companies have raised $4.4 billion in investments in the past decade (2010–2020).

Nearly half, or $2.1 billion, was raised in 2020 alone. This included Impossible Foods’ record $700 million funding haul, which comprised a $500 million Series F in March and a $200 million Series G in August; Oatly’s $200 million private equity and $78 million debt financing; and Califia Farms’ $172 million private equity financing.

Cultivated meat

Received more than $360 million in investments in 2020, which is six times the amount raised in 2019 and 72 percent of the amount raised in the industry’s history (2016–2020). This included the first two series B raises in the segment: Memphis Meats’ landmark $186 million round and Mosa Meat’s $75 million round.

Fermentation

Companies in the world of alternative proteins received $590 million in investments in 2020, which is more than double the amount raised in 2019. This included Perfect Day’s $300 million Series C funding round and Nature’s Fynd’s $45 million debt round—the first disclosed venture debt capital raise by a fermentation company. Fermentation companies have raised more than $1 billion in investments since the first GFI-tracked investment in 2013, 57 percent of which was raised in 2020 alone.

GFI Senior Investor Engagement Specialist Sharyn Murray: “The investor community is waking up to the massive social and economic potential of food technology to radically remake our food system. Early trendsetters like Impossible Foods, Beyond Meat, Memphis Meats, and Mosa Meat continue to perform well, and there are more and more entrepreneurs who see the potential of alternative proteins to succeed in the marketplace while having a positive global impact on food sustainability and global health.”

GFI Director of Corporate Engagement Caroline Bushnell: “2020 was a breakout year for alternative proteins, with record investment flowing into all segments of the industry. This is yet another signal of the significant potential the private sector sees in this rapidly growing global industry. While the amount is record-breaking, more investment is needed—from both the public and the private sectors—to meet the urgency of this moment. A large-scale shift toward alternative proteins will be critical to mitigating the environmental impact of food production, meeting the Paris Climate Agreement, and sustainably feeding a growing global population.”

For deeper insights on the state of alternative proteins, keep an eye out for GFI’s State of the Industry reports, which will be published in May.