The plant-based market is growing steadily, but in the future cell-based products may dominate and increasingly compete with plant-based products. By 2040, plant-based and cell-based meat alternatives are set to account for 60% of the market. We are moving towards a future where meat does not come from animals.

According to Edison Investment Research, cell-based products provide the potential to disrupt the market, especially regarding production with low environmental impact. The industry is expected to be ready for mass production as early as 2025 and to be priced on a par with conventional meat. Large meat producers are already investing, such as Tyson, Cargill and Merck.

8 reasons why the future of meat is cell-based and animal-free

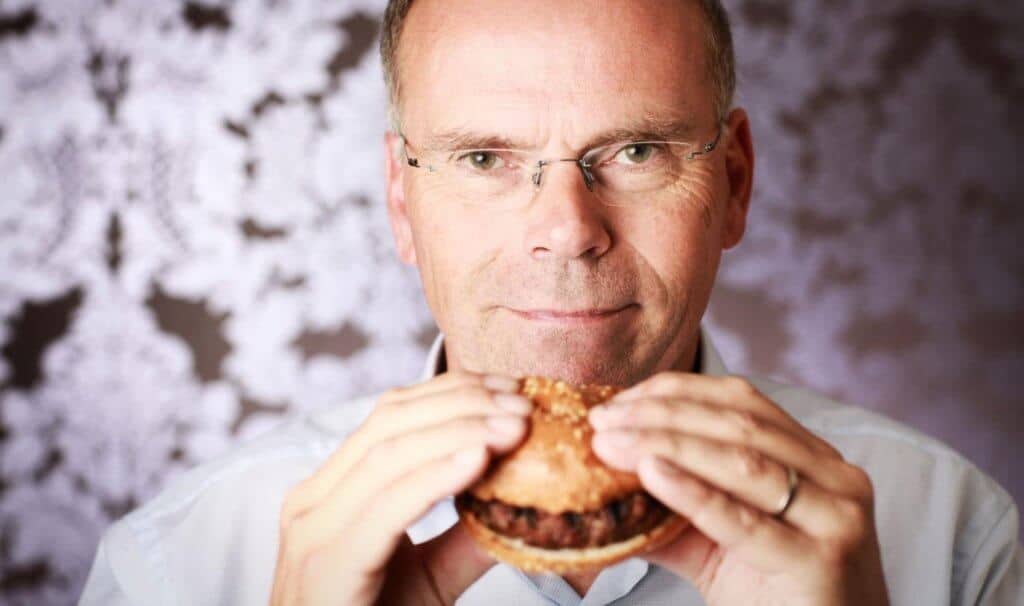

1 – It tastes good: This April, scientists in Maastricht University blind-tested participants and found that they rated the flavour of the ‘cultured’ hamburger as better than that of the ‘ordinary’ one. Furthermore, 58 percent of the respondents said they would be prepared to pay a premium for cultured meat at an average of 37 percent on top of the price of ordinary meat.

2 – Consumer acceptance: French and German consumers were found this September to be open to trying cultured meat and 58% of Germans would like to eat it. A study back in May found consumers to be increasingly accepting of the idea of cellbased meat, with acceptance at almost 50% for younger and more educated respondents. And in 2019 a survey found Asian consumers to be very open-minded to new concepts in food such as cell-based.

3 – Eat Just is in: In October, Eat Just, producer of the phenomenon that is the JUST Egg, announced a $100M facility in Singapore and said that cultured products will be next. Speaking to vegconomist, Just’s Andrew Noyes said: “We’re excited about our small-scale commercial launch of cultured chicken as soon as we have a regulatory pathway.”Anything these guys touch turns to vegan gold, so watch this space.

4 – Investment: In January, Memphis Meat completed the largest funding round in cell-based history with $161 million from investors including Bill Gates and Richard Branson. The EU invested €2.7 million showing that Brussels sees a cellbased future, and in September, UC Davis received a $3.5 million five-year grant for cultured meat research.

5 – Future cost: The Dutch cultured meat pioneer Mosa Meats reduced its production costs by 88 times and the South African producer of cultured beef and chicken Mzansi Meat plans to achieve price parity within the next 5-10 years.

6 – Corporates are already in: Multinational companies are increasingly turning to cell-based, Cargill, for example invested in Aleph Farms and fast-food giant KFC signed an agreement with Mosa Meats to secure the company’s cultured chicken alternatives as soon as they are commercially available. Such commericialisation will allow for compteitive pricing.

7 – Cultured meat is already publicly listed: Israeli startup Meat Tech 3D is the world’s first cultivated meat company publicly listed in Israel and has filed for IPO in the US.

8 – Seafood is very close: The cell-based seafood industry is close to market introduction as BlueNalu plans to launch its cell-based seafood products in the second half of 2021. Shiok Meats plans to launch its minced shrimp products in 2022 and recently unveiled a cultured lobster product at a testing event in Singapore. The lobster product is set to launch to market after the shrimp.

In fact, the challenge for the cell-based industry does not lay in the area of innovation potential or consumer acceptance, but rather in food safety regulations. Forbes said on the matter: “What’s nice about the US regulatory system is that it is product-focused rather than process-focused so instead of making sure every step of our process is the same as how a fish would grow meat, it looks at the end product, which is more scientific.”

In an interview with vegconomist, the founder of Mzansi Meat Brett Thompson agreed: “We’ve seen that the challenge for cultivated meat companies in most markets worldwide is actually regulatory and food safety compliance and not necessarily anything relating to cell proliferation or scale-up.”