World’s first targeted exposure to vegan companies with accelerating sales provided by Beyond Investing, the vegan investing pioneers, via its Swiss-listed Vegan World Index Certificate.

Supermarket shelves in the current climate are bursting with plant-based food in every aisle. Fast food outlets, high street cafes, and chain restaurants are all consistently introducing vegan options. But how to direct your investments towards the animal-free economy? Surely if all these companies are launching products and increasing sales, it must be possible to invest in them and profit from their growth?

Whilst a few of these companies might be found in a conventional investment fund, they’ll sit next to meat and dairy producers, whose profits are under threat from changing consumer preferences.

That’s why Beyond Investing, which made history in 2019 by launching the world’s first vegan-friendly and climate-conscious Exchange Traded Fund, brought to market the world’s first listed investment product that gives the opportunity to invest in and benefit purely from high growth, international plant-based businesses.

The Vegan World Index Certificate tracks the Beyond Investing Vegan World Index. The product of two years of research of over 2,000 global small to midcap stocks this index admits only companies with 100% vegan products, making it the world’s first genuinely vegan thematic stock index.

As Beyond Investing, Head of Ethical Screening, and ethical investment pioneer, Lee Coates OBE explains: “Our Vegan Climate Indexes include all eligible stocks after application of our animal-friendly and environmentally conscious screens. In contrast, to create the Vegan World Index, Beyond Investing applies the same rigorous screens, but selects for investment only those companies whose activities contribute towards the achievement of a world free from animal exploitation, in essence, a vegan world.”

Using financial data and portfolio construction technology from renowned ESG asset manager and impact measurement experts Impact-Cubed, the current 60 Index constituents are ranked for revenue growth, risk, market capitalisation and liquidity.

The Index is tilted towards those stocks with the highest sales growth, highest liquidity, larger market capitalisation and least risk. The weighted average market capitalisation of the Index is $4.8 billion, and the weighted average 1-year sales growth of index constituents is +23%.

On each quarterly rebalance, stocks that have IPO’d or gone vegan are introduced, and the index re-orientated again towards high sales, low risk, high liquidity and larger size. By doing this, the Index aims to contain the latest publicly-listed plant-based shares, and be most exposed to those growing the fastest, whilst avoiding highly volatile and illiquid penny shares.

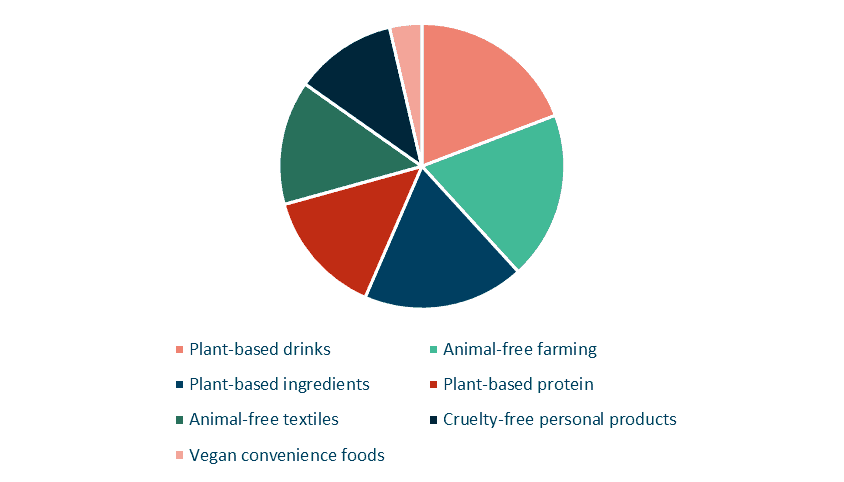

The Index provides exposure across seven key plant-based and cruelty-free market segments as shown in this pie chart.

Among stocks in the Index are companies creating:

- Plant-based protein – alternatives to meat and milk-like high profile Beyond Meat and Oatly

- Plant-based drinks – juices and health drinks – like Celsius and Zevia

- Animal-free textiles – bio-based materials and performance fabrics – like Lenzing and Texhong

- Cruelty-free personal products – cosmetics and skincare – such as ELF Beauty and Fancl

- Plant-based ingredients – starches, oils, algae, and high tech synbio solutions – like Ingredion and Ginkgo Bioworks

- Vegan convenience foods – prepared foods and snacks – such as Kagome

Animal-free farming – growing fresh produce for direct human consumption – like Calavo Growers and Costa Group

A Certificate tracking the Vegan World Index is available for investment on the SIX Structured Products exchange where it can be traded using the Ticker Symbol: SCVLTQ or the ISIN code: CH1134499073

View quotes and trade on SIX Structure Products exchange https://www.six-structured-products.com/en/zertifikat/tracker-zertifikat-CH1134499073#

Download the Term Sheet and Key Information Document at https://structuredproducts-ch.leonteq.com/isin/CH1134499073